child care for working families act 2020

Child Care for Working Families Act. Introduced in House 03022020 Improving Child Care for Working Families Act of 2020.

Working Families Are Spending Big Money On Child Care Center For American Progress

To amend the Child Care and Development Block Grant Act of 1990 and the Head Start Act to promote child care and early learning and for other purposes.

. Specifically the bill provides funds for the Child Care and Development Block Grant program and reestablishes it as a child care and development assistance program. Capping costs for working families 2. HR1364 - Child Care for Working Families Act 116th Congress 2019-2020 Bill Hide Overview.

Across the country too many families do not have access to high-quality early learning and care that will help their children thrive without breaking the bank. O Remodeling renovation repair or construction with priority given to providers of high-. The Child Care for Working Families Act CCWFA would address the current child care crisis in four ways.

This bill provides funds and otherwise revises certain child care and early learning programs for low- to moderate-income families. Last week the President signed a 2 trillion emergency relief bill aimed at providing economic relief to the nations families workers and businesses. Specifically the bill provides funds for the Child Care and Development Block Grant program and reestablishes it as a child care and development assistance program.

B Assistance for every eligible childBeginning on October 1 2024 every family who applies for assistance under this subchapter with. Bobby D-VA-3 Introduced 02262019 Committees. The bills titles are written by its sponsor.

Child Care for Working Families Act. The Coronavirus Aid Relief and Economic Security CARES Act will provide the Administration for Children and Families ACF with 63 billion in additional funding that will aid in the. 37 rows Introduced in Senate 02262019 Child Care for Working Families Act.

9801 note is amended 1 by striking paragraph 1 and inserting the following. This bill provides funds and otherwise revises certain child care and early learning programs for low- to moderate-income families. The Department of Labors Department Wage and Hour Division WHD administers and enforces the new laws paid leave requirements.

The cost of child care has increased by 25 percent in the past decade forcing parents to choose between going to work and paying for child care. To amend the Internal Revenue Code of 1986 to increase the limitation of the exclusion for dependent care assistance programs. During fiscal years 2020 through 2022 a State may use 50 percent of its allotment for quality improvement activities during which time it may use quality improvement funds for.

Expanding access to high-quality preschool programs 4. SUPPORT NARAL Pro-Choice Maryland urges the House Appropriations Committee to issue a favorable report on HB1559. The Families First Coronavirus Response Act FFCRA or Act requires certain employers to provide employees with paid sick leave or expanded family and medical leave for specified reasons related to COVID-19.

The Child Care for Working Families Act would provide access to affordable high-quality child care for low- and middle-income families who need the most support by ensuring that no family under 150 percent of State Median Income would pay more than seven percent of. April 3 2020. The Child Care for Working Families Act CCWFA creates a new standard for inclusive and accessible child care by investing in communities historically underserved by an underfunded child care.

Mar 2 2020. Child Care for Working Families Act. Section 658Ab of the Child Care and Development Block Grant Act of 1990 42 USC.

Improving the quality and supply of child care for all children 3. Child Care and Development Assistance. Increase in limitation of exclusion for dependent care assistance programs a In general.

In fact in 33 states and the District of Columbia infant care costs exceed the. In GovTrackus a database of bills in the US. Section 129a2A of the Internal Revenue Code of 1986 is amended by striking 5000 2500 and inserting 10000 5000.

This bill increases the limitation on the exclusion from employee gross income for employer-paid dependent care assistance from 5000 to 10000. This bill provides funds and otherwise revises certain child care and early learning programs for low- to moderate-income families. A In generalThe Secretary is authorized to administer a child care program under which families in eligible States shall be provided an opportunity to obtain child care for eligible children subject to the requirements of this subchapter.

Programs funded under title II of the Child Care for Working Families Act programs funded under section 657C of the Head Start Act tribal early childhood. Specifically the bill provides funds for the Child Care and Development Block Grant program and reestablishes it as a child care and development. Text for S568 - 116th Congress 2019-2020.

As the First Five Year Fund reports the fiscal 2020 funding bill includes more than 1 billion in increased funding for child care and early learning programs including a 550 million increase for the Child Care and Development Block Grant program and an additional 550 million for Head Start and Early Head Start. Child Care Scholarship Program Alterations Child Care for Working Families Act sponsored by Delegate Pam Queen. Supporting higher wages for child care workers Capping costs for working families.

This Act may be cited as the Improving Child Care for Working Families Act of 2020. Introduced in House - March 2 2020 Bill Summary Improving Child Care for Working Families Act of 2020 This bill increases the limitation on the exclusion from employee gross income for. Families would pay their fair share for care on a sliding scale regardless of the number of children they have.

To amend the Internal Revenue Code of 1986 to increase the limitation of the exclusion for dependent care assistance programs. Our organization is an advocate for reproductive health rights and justice. Child Care Aware of America is a not-for-profit organization recognized as tax-exempt under the internal revenue code section 501c3 and the organizations Federal Identification Number EIN is.

Child Care for Working Families Act. This Act may be cited as the Child Care for Working Families Act. March 10 2020 100pm _____ POSITION.

Child Care for Working Families Act. The Child Care for Working Families Act would address the current early learning and care crisis by ensuring that no family under 150 percent of state median income pays more than seven percent of their income on child care.

Growing The Economy Through Affordable Child Care Center For American Progress

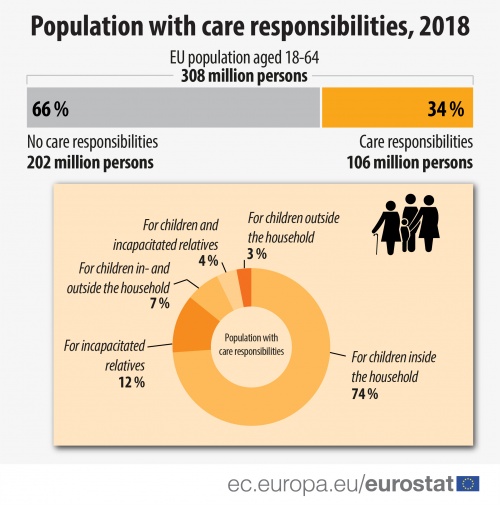

Reconciliation Of Work And Family Life Statistics Statistics Explained

The Build Back Better Act Would Greatly Lower Families Child Care Costs Center For American Progress

Day Long Online Campaign On Movement For Environmental Protection 5th June 2020 Online Campaign Environmental Protection Brush Teeth Kids

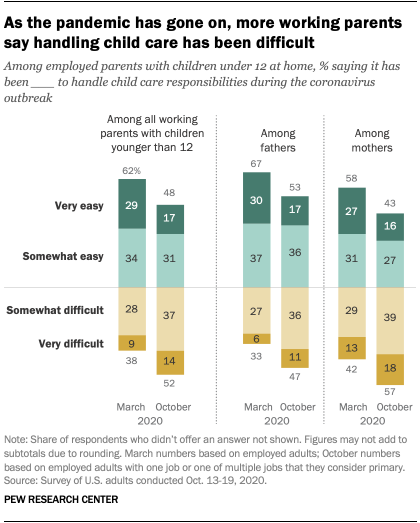

More Working Parents Now Say Child Care Amid Covid 19 Has Been Difficult Pew Research Center

Working Families Are Spending Big Money On Child Care Center For American Progress

Social Emotional Development Brochure Free Resources Social Emotional Development Emotional Development Social Emotional Skills

Working Families The Employers Guide To Childcare Working Families

Child Care Development Block Grant Ccdbg First Five Years Fund

America After 3pm After School Program Educational Infographic School Readiness

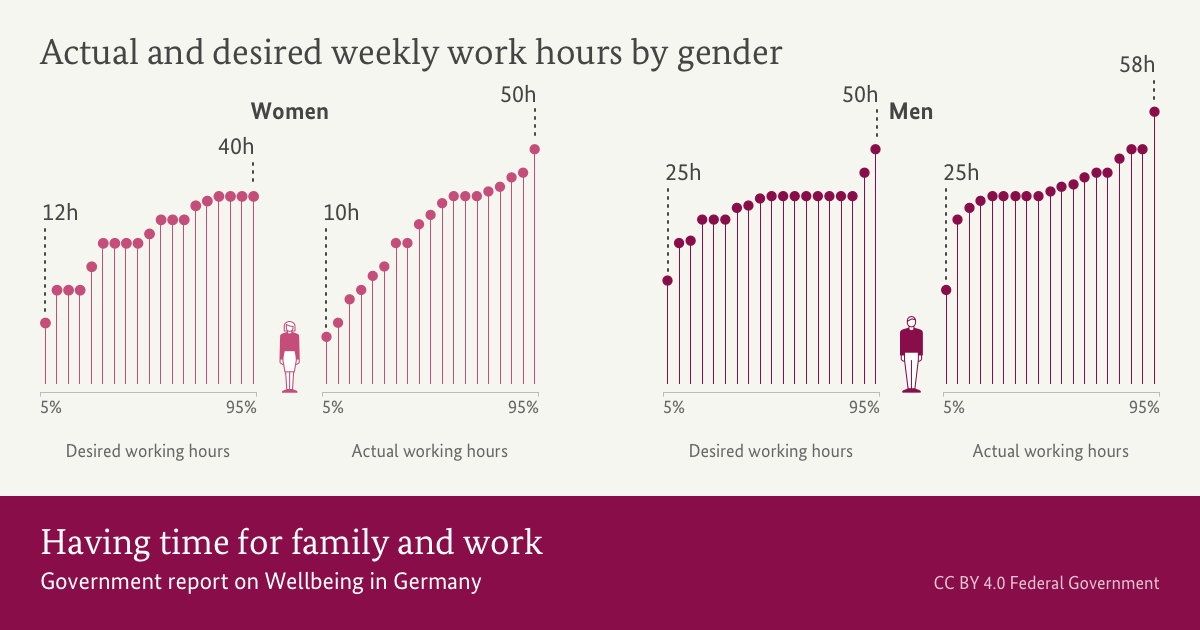

Having Time For Family And Work Wellbeing In Germany

Compassion Fatigue Don T Wait Until It Hurts You Compassion Fatigue Fatigue Compassion

Working Families Are Spending Big Money On Child Care Center For American Progress

More Working Parents Now Say Child Care Amid Covid 19 Has Been Difficult Pew Research Center